In today's fast-paced world, effective budgeting is vital for financial wellbeing, especially for beginners in the UK. The 50/30/20 rule has emerged as a popular solution for managing personal finances. It offers a straightforward approach to help individuals control their spending, reduce debt, and save for the future—all without feeling deprived.

Understanding how to apply this rule can simplify the budgeting process, making it feel less overwhelming. In this post, we will break down the 50/30/20 rule, discuss its components in detail, and provide practical tips for effectively integrating it into your financial routine.

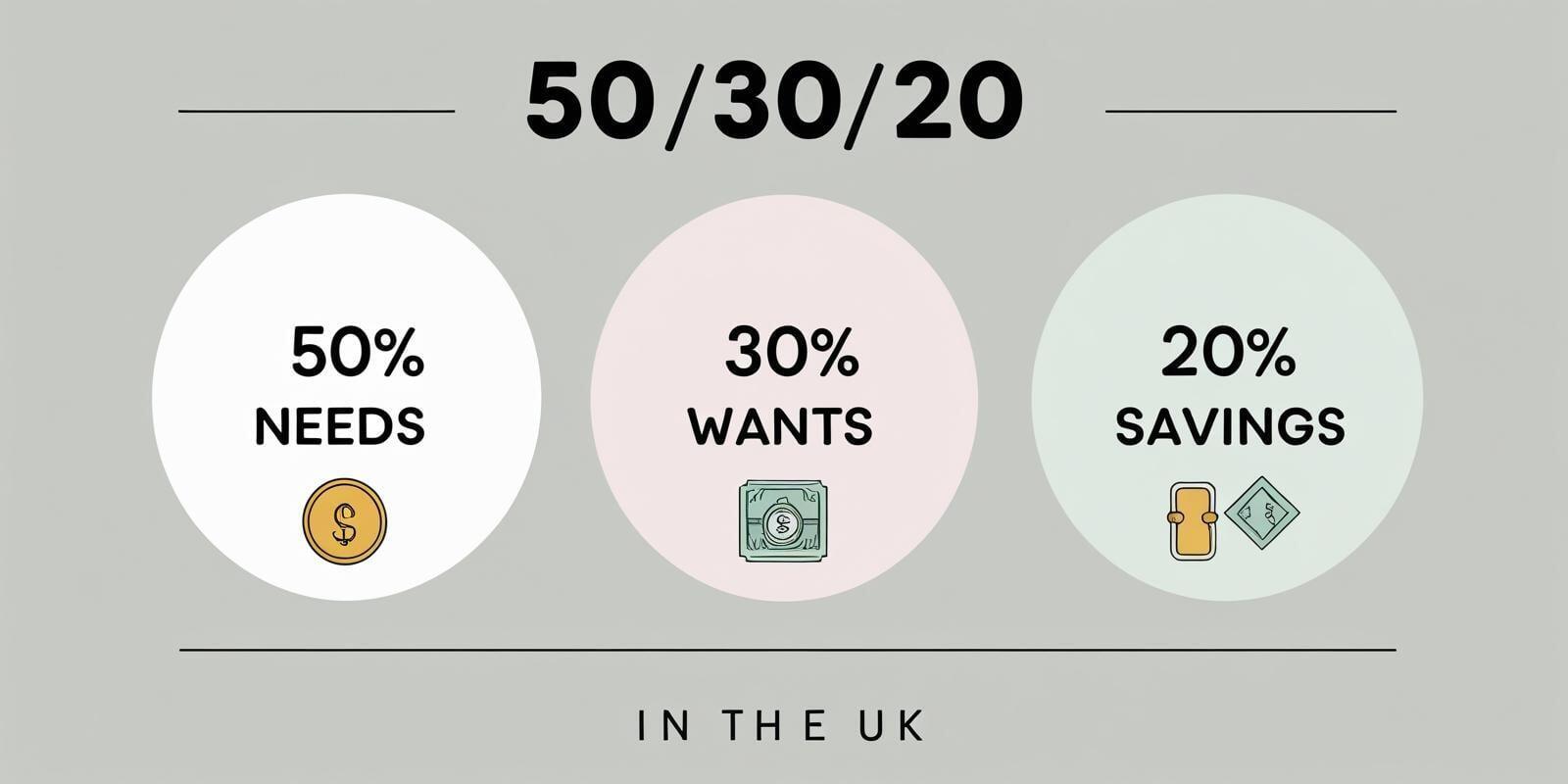

What is the 50/30/20 Rule?

The 50/30/20 rule is a clear budgeting guideline dividing your income into three essential categories: needs, wants, and savings or debt repayment.

50% for Needs: This portion includes your essential expenses—things you cannot live without. Examples include:

Housing (mortgage or rent)

Utilities (electricity, water, gas)

Groceries

Transportation (public transport fares or vehicle maintenance)

Insurance (health, home, car)

Minimum loan repayments

This category typically consumes a significant part of your income, yet it represents necessary costs for everyday living.

30% for Wants: This category covers discretionary spending. While enjoyable, these expenses are not essential for survival. Examples include:

Dining out at restaurants (averaging £40 per meal)

Travel and vacations (like a weekend getaway or a summer holiday)

Hobbies (such as walking tours or art classes)

Subscriptions (like Netflix, gym memberships, or hobby clubs)

These costs allow for enjoyment but should be kept in check.

20% for Savings and Debt Repayment: The last segment is for saving or paying off debt. Examples can include:

Building an emergency fund (general advice is to save at least three to six months of expenses)

Contributing to a retirement account (which can significantly grow thanks to compound interest)

Paying off high-interest debts (such as credit card balances)

This allocation fosters financial security and protects against unexpected financial issues.

This clear structure makes it easier to manage your resources, ensuring you do not overspend.

Benefits of the 50/30/20 Rule

The 50/30/20 rule simplifies budgeting, which can often feel complex and frustrating. By breaking down spending into clear categories, it helps beginners understand where their money is going and encourages better financial habits.

Moreover, the balanced allocation allows for a fulfilling lifestyle. By covering both essential needs and discretionary wants, you can enjoy life while fulfilling your financial responsibilities.

Another significant benefit is the focus on savings. Regular contributions can lead to financial stability, dampening the impact of unexpected expenses; for instance, even saving £100 a month can grow into £1,200 over a year.

How to Apply the 50/30/20 Rule

Applying the 50/30/20 rule is straightforward and involves several clear steps.

1. Calculate Your Income

Start by determining your monthly income. This figure represents the money you take home after taxes and deductions. Include all income sources—salary, bonuses, and any freelance or side gigs.

2. Determine Your Expenses

Next, list all your monthly expenses under two main categories: needs and wants.

Needs:

Housing (mortgage or rent)

Utilities (electricity, water, gas)

Groceries (aim for an efficient budget of around £250 monthly for one person)

Transportation (factor in costs for public transport or fuel)

Insurance (health, home, car)

Minimum loan repayments

Wants:

Eating out (consider limiting to £100 per month for dining out)

Travel (plan for trips without overextending your budget)

Hobbies (set aside funds for activities or classes)

Subscriptions (keep these to what you frequently use)

3. Categorize Your Spending

Once you have listed your expenses, categorize them according to the 50/30/20 rule. Ensure:

Your needs do not exceed 50% of your income.

Discretionary spending stays within 30%.

Aim to save or put aside 20% of your income for future goals.

4. Adjust as Necessary

Your budget may require adjustments. If you consistently overspend in one category, identify where to cut back. This might involve making tough choices, such as dining out less frequently or delaying a vacation.

Tips for Success with the 50/30/20 Rule

To successfully master the 50/30/20 rule, consider these practical tips:

Use Budgeting Tools: Numerous apps and online tools can help track expenses and manage your budget. Consider using resources like Mint or YNAB to simplify your financial tracking.

Review Monthly: Regularly evaluate your budget each month. This practice aligns you with your financial goals, allows for necessary adjustments, and helps avoid surprises.

Set Up Automatic Transfers: To ensure consistent savings, set up automatic transfers to your savings account right after receiving your income. This makes savings a priority rather than an afterthought.

Spend Mindfully: Adopt a mindful attitude toward spending. Regularly ask yourself whether your purchases align with your long-term goals and values.

Potential Obstacles

While the 50/30/20 rule provides an excellent framework, challenges may arise. For example, high living costs in cities like London can make it tough to keep your needs under 50% of your income.

In these cases, consider adjusting the percentages or finding ways to lower expenses, such as sharing housing costs or increasing your income through a side job.

Ultimately, the goal is to find a balanced approach that suits your unique financial situation.

Embracing the 50/30/20 Rule

Mastering the 50/30/20 rule can be a significant step toward achieving financial stability. By clearly understanding this budgeting strategy and taking action, beginners can take control of their finances and anticipate a more secure future.

Remember to adjust the rule according to your specific financial circumstances and priorities. With dedication and mindful spending, you can make the 50/30/20 rule a cornerstone of effective budgeting.